Setting Up New York SDI Tax

The New York State Disability Insurance (NY SDI) Tax pays for temporary disability insurance for employees within the State of New York. The system calculates the NY SDI tax directly for employees and optionally for client. The system bypasses Vertex tax calculation engine for this tax. Therefore, your organization must set up the tax rates in PrismHR. See Calculating NY SDI Tax for more information on how PrismHR calculates the NY SDI tax.

Note: As of January 1, 2011, the rate for calculating employee NY SDI is 0.50% of wages per week up to a maximum of $0.60.

Establishing Tax Rates and Limits

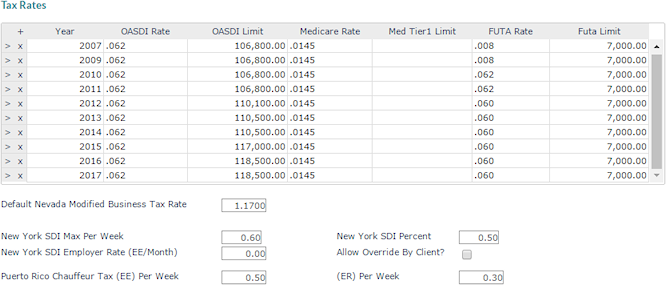

Set various tax rates and limits in the Tax Rates form.

To establish tax rates and limits:

| 1. | Click |

| 2. | From System|Change select System Parameters. |

| 3. | Select Tax Rate Maintenance from the Actions menu. The Tax Rates form opens. The employee tax is always calculated. The employer (client) tax calculation is optional. To calculate the employer (client) tax, enter the monthly tax rate per employee. |

| 4. | Complete these fields: |

| Field | Description |

|---|---|

| New York SDI Max Per Week | Enter the amount that is deducted each week from an employee who lives in New York. |

| New York SDI Percent | Enter the percent that is the taxable gross rate. |

|

New York SDI Employer Rate (EE/Month) |

Enter the employer rate that is calculated monthly for each employee who lives in New York. |

|

Allow Override By Client |

Select to permit overrides of the NY SDI tax. |

| 5. | Click Save. |

Setting Tax Parameters

Set tax information for the client in the Tax Parameters panel.

To set tax parameters:

| 1. | Select Client. |

| 2. | From Client|Change, select Client Details. |

| 3. | Select the Tax tab. |

| 4. | Complete the following fields: |

| Field | Description |

|---|---|

| Calculate Employer Paid New York SDI | Select to calculate the employer-paid New York disability tax for each of the client's employees. |

| New York SDI Employer Rate (EE/Month) | Enter the insurance premium rate (per employee/per month) paid by the client for New York Disability Insurance. |

| New York MCT Override Rate |

Enter the rate based on the total company payroll expense. If left blank, the system uses the default rate of 0.34% to calculate the tax. |

| 5. | Click Save. |

Note: To credit the employer (client) for the amount of any NY SDI that has been deducted from an employee’s pay check, you must set up an unbundled billing rule. See the Payroll User Guide for more information on setting up unbundled billing rules.

Calculating NY SDI Tax

The system calculates the NY SDI tax for employees and employers (client).

| Tax Type | Batch Type | Replaces Regular Batch? | Voucher Type | Calculation Method |

|---|---|---|---|---|

| Employee | Regular | N/A | Regular | Lesser of (Weeks-Worked X 0.60) or (Taxable Gross X 0.05%) |

| Employee | Regular | N/A | Vacation | If Pay Period is the same as Regular voucher no tax will calculate. Otherwise will use same calculation method as a regular voucher. |

| Employee | Regular | N/A | Supplemental | No tax will be calculated |

| Employee | Special/Manual | Yes | Regular | Lesser of (Weeks-Worked X 0.60) or (Taxable Gross X 0.05%) |

| Employee | Special/Manual | Yes | Vacation | If Pay Period is the same as Regular voucher no tax will calculate. Otherwise will use same calculation method as a regular voucher. |

| Employee | Special/Manual | Yes | Supplemental | No tax will be calculated |

| Employee | Special/Manual | No | Regular | Will loop thru vouchers with pay dates within pay period entered on batch. For any voucher regular voucher found that did not take maximum 0.60 will apply tax calculation to this voucher to make up for tax not withheld. |

| Employee | Special/Manual | No | Vacation | No tax will be calculated |

| Employee | Special/Manual | No | Supplemental | No tax will be calculated |

| Employee | Manual Check | N/A | Regular | Tax calculated same as regular check in a regular batch |

| Employee | Manual Check | N/A | Supplemental | No tax will be calculated |

| Employer | Regular | N/A | Regular | Tax calculated at a rate of 4.30 per month. Tax billed on the first voucher processed in the month. |

| Employer | Regular | N/A | Vacation | If Pay Period is the same as Regular voucher no tax will be calculated. Otherwise will use the same calculation method as a regular voucher |

| Employer | Regular | N/A | Supplemental | No tax will be calculated |

| Employer | Special/Manual | No | Regular | No tax will be calculated |

| Employer | Special/Manual | No | Vacation | No tax will be calculated |

| Employer | Special/Manual | No | Supplemental | No tax will be calculated |

| Employer | Special/Manual |

Yes |

Regular | Tax calculated at a rate of 4.30 per month. Tax billed on the first voucher processed in the month. |

| Employer | Special/Manual | Yes | Vacation | If Pay Period is the same as Regular voucher no tax will be calculated. Otherwise will use the same calculation method as a regular voucher |

| Employer | Special/Manual | Yes | Supplemental | No tax will be calculated |

| Employer | Manual Check | N/A | Regular | Tax calculated same as a Regular voucher in a Regular batch. |

| Employer | Manual Check | N/A | Supplemental | No tax will be calculated |