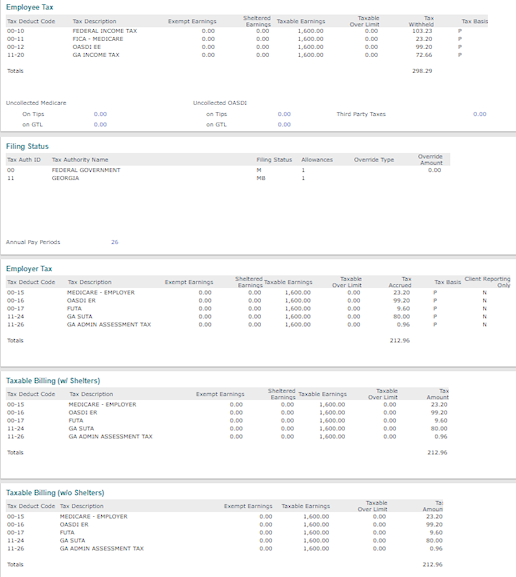

| Employee Tax |

|

•

|

Tax Deduct Code: Distinct system-generated tax code that identifies Federal, State, and Local tax withholding. |

|

•

|

Tax Description: Description of the tax deduction code, which you can define and modify in the Tax Deductions form on the System|Change menu. When the system generates a new tax, you might want to modify the description. |

|

•

|

Exempt Earnings: Any earnings that are considered exempt and excluded from taxable wages. Exempt earnings vary between Federal, State, and Local tax rules, which you can configure in PrismHR. |

|

•

|

Sheltered Earnings: Earnings that are a portion of wages not subject to a specific tax. This might vary between Federal, State, and Local tax withholdings. Also, they can reflect multiple types of income deferral including contributions to retirement, section 125 deductions, and other various methods. Refer to your Federal, State, and Local tax laws to determine sheltered earnings for each tax deduction. |

|

•

|

Taxable Earnings: Total wages that are considered taxable for the voucher (excluding Exempt and Sheltered earnings). |

|

•

|

Taxable Over Limit: Taxable wage limits vary by tax deduction. This value reflects the amount of wages that are over the wage limit and therefore not taxable. |

|

•

|

Tax Withheld: Calculated tax amount to be withheld from the employees' wages based on the taxable wages that are not over the limit. |

|

•

|

Tax Basis: Identifies whether the taxable wage type is reported on the Employer (P) or Client Level (C). You can define this setting on the State Rules form, which can be overridden in various ways. |

Note: There might be scenarios where an employee is paid with both cash and non-cash pay codes and there is not sufficient cash to cover the tax deductions in full, which are listed on the voucher as Uncollected Medicare | OASDI (see Uncollected Social Security and/or Medicare).

|

| Filing Status |

This panel reflects the employee's tax filing information used to calculate the taxes for the voucher. The information included is listed below:

|

•

|

Tax Authority Name (Description). |

|

•

|

Override type (if any). |

|

•

|

When an override is present, the Override amount indicates the value that determines the tax amount in the Employee Tax section of the voucher. |

|

•

|

Annual pay periods reflect the number of pay periods that calculate the taxable wages to determine the withheld tax. |

|

| Employer Tax |

This panel reflects the accrual tax values as outlined below.

Note: Tax Deduction Code|Description|Exempt|Sheltered|Taxable|Taxable Over Limit remains the same as outlined in the Employee Tax panel, although the amounts might vary based on Federal, State, and Local tax laws. You will notice a difference in the tax deduction codes between employee and employer taxes as well.

|

•

|

Tax Accrued: Displays the tax liability amount accrued for the specific tax code. (Many tax rates are configurable in PrismHR.) |

|

•

|

Tax Basis: Identifies whether the taxable wage type is reported on the Employer (P) or Client (C|CL) Level. You can define this setting on the State Rules form, but it can be overridden in various ways. When SUTA is reported on the worksite level, the tax basis report displays as CL. Otherwise, Client-reported taxes display as C. |

|

•

|

Client Reporting Only: Certain states set SUTA rates on the PEO level, but the PEO is required to report on the Client level. When you select the Client SUTA Report Only option on the State Rules form, the Client Reporting only field on the Employer Tax panel displays Y. |

|

| Taxable Billing (with and without Shelters) |

The Taxable Billing (w/ Shelters) and Taxable Billing (w/o Shelters) panels display the amounts billed to the client based on the current billing template assigned to that client. The billing template allows flexibility in how you choose to bill your client on wages with sheltered earnings. (Refer to the PrismHR Billing User Guide for information on how to use the Billing Templates form to define methods for billing clients.)

Taxable Billing (w/ Shelters): Reflects the billed amounts for each tax deduction when the billing template includes the Discount Shelter option. (Sheltered earnings are reduced from the taxable earnings to calculate the bill amount.)

Taxable Billing (w/o Shelters): Reflects the billed amounts for each tax deduction when the billing template does not include the Discount Shelter option. Sheltered earnings do not display, and the taxable earnings include sheltered wages to calculate the bill amount.

|