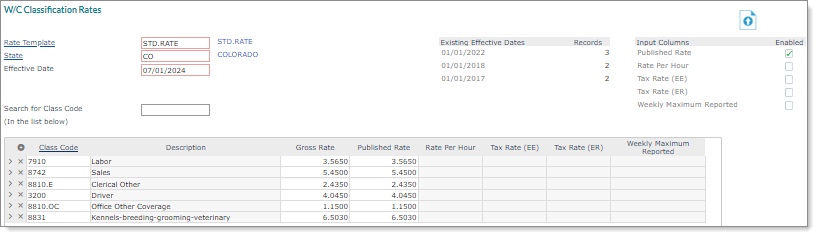

Defining W/C Classification Rates

You can use the W/C Classification Rates form to maintain workers’ compensation classification rate information. For example:

Note: Click the Data Import Tool icon (![]() ) to import W/C rates at the system level. (See the Payroll Administration Guide for more information about using the Global W/C Classification Rates Import Template option to perform this import.)

) to import W/C rates at the system level. (See the Payroll Administration Guide for more information about using the Global W/C Classification Rates Import Template option to perform this import.)

To define workers’ compensation classification rate information, do the following:

| 1. | Go to the W/C Classification Rates form and complete the following fields: |

| Field | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Rate Template | Select the Rate Template. | |||||||||

| State | Select the State. | |||||||||

|

Effective Date |

Enter a new Effective Date for this rate template, or select an existing date from the table at the right. |

|||||||||

|

Input Columns/Enabled |

For the Input Columns you need to update, select Enabled. |

|||||||||

|

Search for Class Code |

Use the Search for Class Code field if you want to look for a specific code that is already in the table. |

|||||||||

|

Class Code/Gross Rate/Published Rate |

For each workers’ compensation classification code:

|

Note: The following fields are only used for the state of Washington. Note that W/C is only calculated on the first 160 hours per month in this state.

| Field | Description |

|---|---|

| Gross Rate | Enter the Gross Rate. |

|

Tax Rate (EE) |

Enter the Tax Rate (EE) charged to employees for workers’ compensation. |

| Tax Rate (ER) | Enter the Tax Rate (ER) charged to employers for workers’ compensation. |

| 2. | Click Save. |