Creating Weighted Average Calculations for Pay Codes

Your organization can create weighted average calculations for pay codes using the Weighted Average form. For example, California requires that employees be paid at their “regular rate” when using state-mandated paid time off. Other states, such as Arizona, permit a regular rate calculation rate.

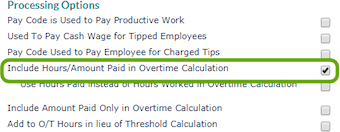

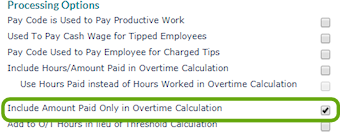

Weighted averages are used for either pay codes that are set to include hours/amount paid in overtime calculations or those that include amount paid only:

When applied to a pay code, it provides a weighted average of pay over a specified time frame. You might use weighted averages when improving calculations for FLSA.

Use weighted average calculations when you need to:

|

•

|

Tie FLSA logic into weighted average pay code logic to pick up minimum wage rates when performing calculations. |

|

•

|

Look at previous periods for compliance. (Typically, you would use lookback periods for salaried employees.) |

Please note that you should use caution when using the pay code for tipped employees with pay rates below minimum wage. Currently the calculation does not gross all such rates up to the minimum wage. Also note that weighted averages do not include system-calculated shift differentials within the payroll that the pay code is used.

|

1.

|

Select Calculated Weighted Average Pay Rate to indicate that the pay code will use a calculated weighted average pay rate. |

|

2.

|

The Exclude FLSA Exempt Employees field is a checkbox. This field is un-checked by default. You can check it and click Accept to enable this option. |

|

•

|

When unchecked, any FLSA exempt employee will have their pay rate recalculated when paid with applicable pay codes. |

|

•

|

When checked, no FLSA exempt employee will have their pay rate recalculated. The pay rate will default to their standard hourly pay rate. |

|

3.

|

Enter each required pay period weighted average calculations: |

|

a.

|

Select the Pay Period: weekly, biweekly, semi-monthly, or monthly. |

The work week method can be used only with weekly and biweekly pay periods.

|

b.

|

Select the weighted average Method: |

|

•

|

Work Week: Based on a single payroll and the pay period is divided into seven-day increments. The weighted average is determined for the week encompassing the charge date. |

|

•

|

Pay Period: Based on a single payroll. The weighted average is determined for all charge dates within the payroll. |

|

•

|

Look back, full periods: Based on all vouchers with both a period start and period end date within the lookback period of the weighted average pay code’s charge date. |

|

•

|

Look back, period end: Based on all vouchers with a period end date within the lookback period of the weighted average pay code’s charge date. |

|

c.

|

If you selected a look back method, enter the Lookback Period number and then indicate whether the period is Days or Months. |