Creating PTO Registers

Use the PTO Register Types form to create or update a PTO register. PTO registers track the usable hours of PTO that employees accrue over the course of the year. The events the trigger PTO accrual, and the strict definition of "year," are defined on this form.

Note: The PTO Register Type indicates when employees accrue paid time off. The PTO Benefit Plan indicates how much paid time off employees accrue.

To create a PTO register:

| 1. | Click the Client menu. |

| 2. | From Client|Change, select PTO Register Types. The PTO Register Types form opens. |

| 3. | Complete the following: |

| Field | Description | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PTO Type Code |

Enter a unique PTO Type Code for this register. For example, V for vacation, S for sick, or P for personal time. (Required.) Note: For new PTO Register Types, the Paid Absence option is enabled by default. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Description | Enter a register description. (Required.) | ||||||||||||||||||||||||||||||||||||||||||||||||

| PTO Class |

Enter the PTO Class that restricts the number of register types that can be assigned to an employee. (Required.) Paid absence benefits are typically provided on a yearly basis. The year-to-date period for tracking benefits is based on the anniversary of each employee’s hire date or some fiscal year basis. If you use anniversaries, the employee year ending dates will vary. If you use a fiscal year end basis, all employee registers end on the same day. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Year End Basis |

Select the Year End Basis that this register tracks. (Required.) |

||||||||||||||||||||||||||||||||||||||||||||||||

| Fiscal End Month/Day |

If the Year End Basis is Fiscal, enter the Fiscal End Month/Day when each fiscal year ends. Note: The Trigger Method and Trigger Date fields work together to determine when an accrual occurs and through which date the accrual calculates. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Trigger Method |

Select the accrual calculation that triggers during payroll processing. (Required.)

Note: A warning message displays when you select End of Quarter, "Warning: Flat amount is the only Plan Calculation supported by End of Quarter Trigger Method. The Year End Basis must also be Fiscal Year ending on 6/30." Click OK to continue.

Note the following:

Note: This option is available only when you set the Year-End Basis to Anniversary. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Trigger Date |

Select the date through which the accrual calculation is triggered. The options vary based on the selected Trigger Method. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Print on Check |

Select if balances for this register type should print on employees’ payroll check stubs. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Pay Stub Name |

Enter a name to describe the PTO register type. This will appear on each employee’s payroll check stub and certain reports. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Inactive Register |

Select if this register type is no longer used. The system will not calculate accruals or update existing employee registers. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Paid Absence |

Select to indicate that this PTO register is for tracking paid absences. (This option is for informational purposes only.) |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Auto-enroll Through-Date is Day Before Start Date |

Select to force the accrued through date to be the day before the start date when auto-enrolling employees in plans for this register type. This can help to ensure that auto-enrolled employees do not lose accrual for that day. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Display a Warning If Employee Uses More Hours Than Available |

Select to display a warning during payroll initialization if an employee uses more hours than currently available. |

| 4. | Click Save. |

Scheduling Holidays

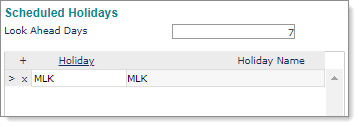

This setting displays if you set the register type Trigger Method to Holiday (see above). Use the Scheduled Holidays panel to ensure that the PTO register accrues holiday-based PTO at the appropriate time (determined by a "look ahead" period).

To schedule a holiday:

| 1. | Click the Client menu. |

| 2. | From Client|Change, select PTO Register Types. |

| 3. | In Trigger Method, select Holiday. The Scheduled Holidays panel displays. |

| 4. | Complete the following: |

|

Field |

Description |

|---|---|

|

Look Ahead Days |

Enter the number of days to look ahead for holiday-based accrual. This acts as an offset. For example, if the pay period start and end dates are June 1 and June 15, and the Look Ahead Days is 7, the system checks for holidays between June 8 and June 22. |

|

Holiday |

Click Holiday and select one or more holidays from the list, then click Accept. The Holiday Name fills in. |

| 5. | Click Save. |

Defining Intervals That Trigger an Accrual

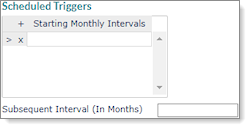

To define intervals (in months) that trigger an accrual, use the Scheduled Triggers panel.

To define an interval:

| 1. | Click the Client menu. |

| 2. | From Client|Change, select PTO Register Types. |

| 3. | In Year-End Basis, select Anniversary. In Trigger Method, select Scheduled. The Scheduled Triggers panel displays. |

| 4. | Complete the following: |

|

Field |

Description |

|---|---|

|

Starting Monthly Intervals |

Enter the number of months during an employee’s first year of employment when paid time off hours accrue. The last interval in the list should be 12. |

|

Subsequent Intervals |

Define the regular interval (in months) when hours accrue after an employee’s first year. |

| 5. | Click Save. |

Using Customized Accrual Subroutines

If the client uses an accrual method that differs from methods previously described, use a customized accrual subroutine.

Note: Contact a systems professional to design a subroutine using the parameters described here.

To design a subroutine:

| 1. | Click the Client menu. |

| 2. | From Client|Change, select PTO Register Types. |

| 3. | In Trigger Method, select Custom Basic Routine. The Custom Basic Subroutines panel displays. |

| 4. | In Trigger Subroutine, enter a custom trigger method subroutine to determine whether hours should accrue for each employee. The format is: |

|

SUBROUTINE SUBR.NAME(ABSENCE.REGISTER.REC,EMPLOYEE.SSN,ACCRUAL.TRIGGERED) |

|---|

| The variable ACCRUAL.TRIGGERED should return either a 0 (zero) or 1 (one). If the value returned is 1, the system calculates an accrual. |

| 5. | In Calculation Subroutine, enter a customized subroutine to replace the standard daily accrual calculation. The subroutine must have the following parameter list: |

|

SUBROUTINE SUBR.NAME(COMPANY.NO,EMP.SSN,REG.TYPE,ABSENCE.REGISTER.REC, BENEFIT.PLAN.REC,VOUCHER.REC,HOURS.ACCRUED) |

|---|

|

The hours accrued should be returned in the variable HOURS.ACCRUED. The calling program does not accept the return of a negative number. If the system returns a negative number, it is set to zero instead. Do not return a number with an embedded decimal point because it will be truncated. |

| 6. | Click Save. |